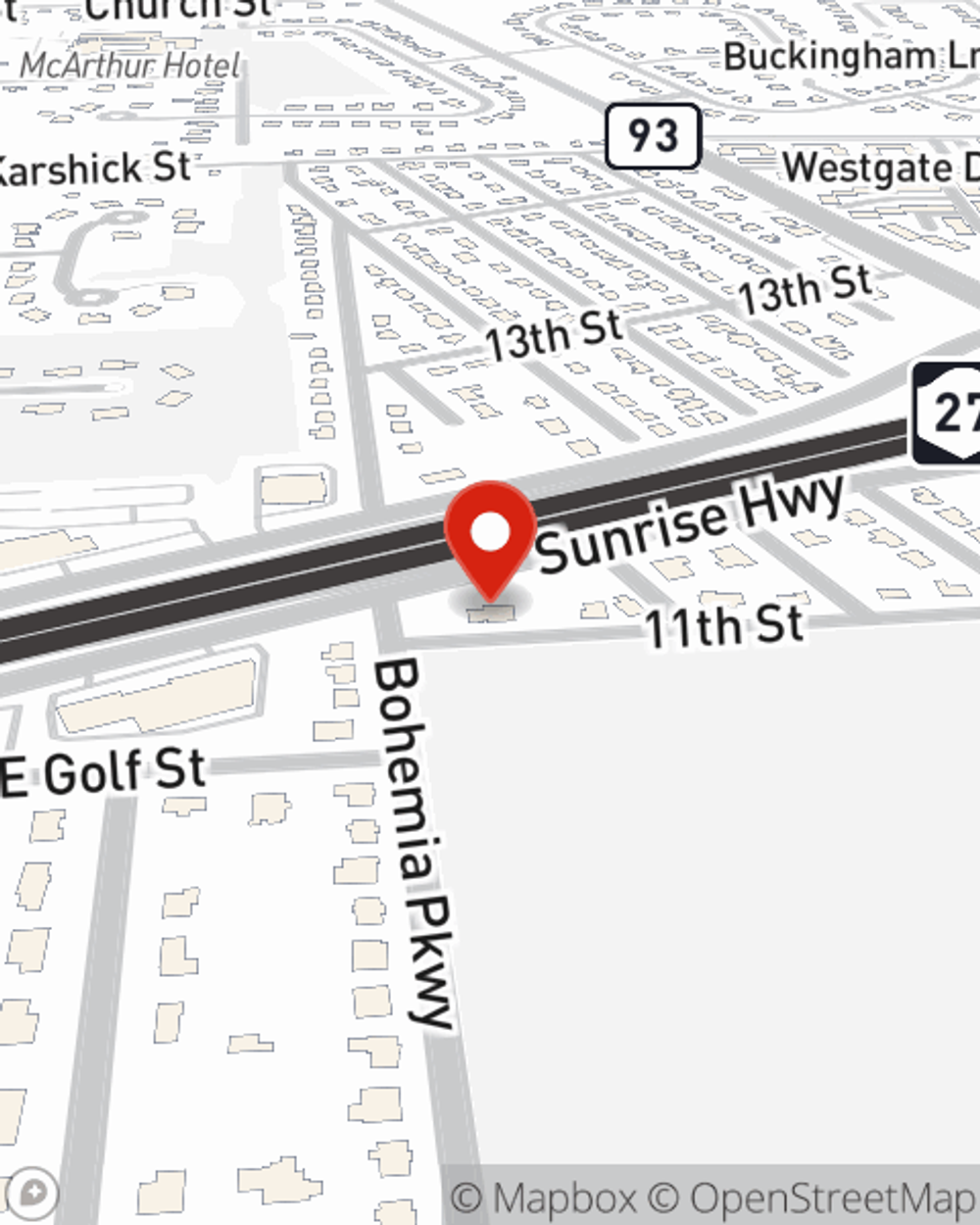

Condo Insurance in and around Sayville

Unlock great condo insurance in Sayville

Insure your condo with State Farm today

Welcome Home, Condo Owners

When looking for the right condo, it's understandable to be focused on details like neighborhood and your future needs, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Unlock great condo insurance in Sayville

Insure your condo with State Farm today

Safeguard Your Greatest Asset

Things do happen. Whether damage from weight of snow, vandalism, or other causes, State Farm has terrific options to help you protect your condominium and personal property inside against unpredictable circumstances. Agent John Pawlowski would love to help you provide you with coverage that is personalized to your needs.

Want to explore the State Farm insurance options that may be right for you and your condo? Simply contact agent John Pawlowski's team today!

Have More Questions About Condo Unitowners Insurance?

Call John at (631) 589-7811 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

John Pawlowski

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.